Has someone failed to pay you back the money once borrowed no matter how many chances you have given them? You move the court for the recovery of the money you deserve to receive. if you are thinking of a lawsuit for money recovery, then we need to first know how the process works and what do you need to do in order to recover your possession. This blog also provides an overview of the people who can file a money suit under the Civil Procedure Code of 1908 and the steps in filing a money suit.

Table of Contents

What is Money Suit?

A Money suit is a suit initiated at the court to recover money.

Who can File a Money Suit?

Every person, who has a right to sue, can file a money suit. This category of people includes:

1. the Principal and Agent

2. Co-holders of a debt or actionable claim

3. Partners

4. Trustee and Trust beneficiary

5. A Religious Institution and its Member(s)

6. A Hindu Joint Family & Its Members

7. Banking Companies and Financial Institutions

8. Civil and Military Officers (for recovery of fine or penalty)

9. Other Statutory Authorities

10. Executor so on and so forth.

Where can we file a money suit?

In order to file any suit, the court must have “jurisdiction over your person” and “jurisdiction over the subject matter of the suit” for a valid judgment. If you are to file a money suit against another, there is a jurisdictional requirement that must be observed. The law requires the defendant to be sued in the place where the contract was made or where it was broken. The question that arises is where can a person sue for recovery of money under money suit?

Territorial Jurisdiction

This is the first thing to look at before instituting a suit and while you decide where to file the case is to see if the court has territorial jurisdiction over the person. Under the Code, while deciding the territorial jurisdiction, these factors are looked into:

- place of residence of the defendant

- place where the defendant has his/ her business and earns thereof.

- the place of cause of action wholly or partially.

Pecuniary Jurisdiction

Alongside the territorial jurisdiction, the pecuniary jurisdiction has to be taken into consideration. This is related to the subject matter of the suit. This criterion is mainly important to decide the place of suing in relation to the monetary value of the suit. The case will be filed as per the monetary value of the suit. one has to keep in mind that the territorial jurisdiction is determined before looking into the pecuniary jurisdiction.

How to recover money under a money suit

After developing an idea of what a money suit is and deciding both the territorial as well as the pecuniary jurisdiction of the case, let us discuss the legal action taken against the defaulter for the recovery of money.

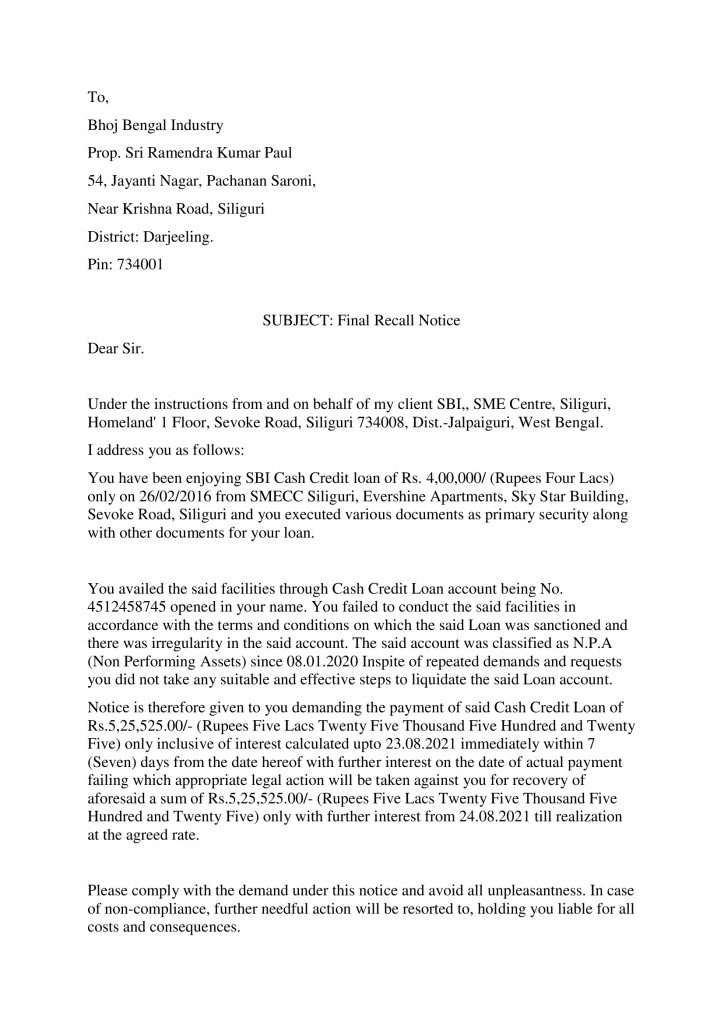

Step A. Demand notice for money suit

The term demand notice is a formal document sent by the plaintiff to the defendant to solve a dispute. This is the first step taken by the concerned party before taking against the defaulter. The notice contains claims for the damages which need to be compensated by the defaulter. The recipient of this letter shall be told of the consequences if the demand in the notice is not met.

The defendant/ defendants need to take a better look at it and reply instead of neglecting it. If not done so, it can be used against him in a court of law showing that from the very beginning he had no intention to return the money even after the notice was in his knowledge. These demand notices are drafted by the lawyers on behalf of an aggrieved individual or a body corporate.

Money Suit Notice Format

Step B. Normal Procedure of money recovery

Once the demand notice has been not answered to or neglected, the plaintiff moves to the stage of trial wherein he institutes by way of a plaint. Let us first go through the steps for the recovery money

The suit is instituted under Order IV of the code by the presentation of a plaint. the Plaint must contain the following:

- the name of the court in which the suit is filed, the facts concluding that the court has the appropriate jurisdiction to try the case. (this is in accordance with the territorial and pecuniary jurisdiction.)

- the names, the details, and the residence of bothe the plaintiff and the defendant.

- material facts with main focus on the cause of action.

- next comes the prayer clause of the plaintiff which discusses the relief that the plaintiff wishes to seek from the Hon’able Court.

- all of these documents need to be attached with an affidavit containing the signature of the plaintiff.

Order 7 Rule 2 specifically talks about the money suit. Here the plaintiff who seeks recovery of the money suit, the plaint will include the precise amount or the value sued for.

Steps after the institution

- Issuance of summons– Court Summons are issued under Order V of the Code whereby the the defaulter is being served a court notice to let him know a suit has been instituted against him and call him beofre the Judge or an officer of the court as the case maybe. The summons need to be sent within 30 days of the institution of the suit.

- Written Statement: The written statement is a statement written by a lawyer on behalf of the defaulter. it is basically an answer to the plaint.the written statement must be presented within 30 days from the service of summons. in case of failure another 60 days is provided to him/her but valid reasons for the delay needs to be provided. through thi statement the person will try to to portray that the suit insttuted is not mainable and that the claim made is either void or voidable along with socuments to support his claim

- Framing of issues, arguments and decree– After this the issues are thus framed followed by the argument presented by both the parties, settlement of the issues. the evidence is collected, looked into ans after that the arguments are heard and decree is given.

- Execution of a decree– After the decree is passed by the Judge, the execution of the decree is an imporant step as it helps in the enforcement of the decree under Order 21. the main aim of this is to get the judgement debtor or the judgement creditor satified with what they will recieve.

However, in case of a summary suit instituted under Order XXXVII of the code, the advantage is that this gives speedy recovery. Written statements per se are not taken into consideration and after the institution of a plaint, the summons is sent to the defaulter. he/ she has only 10 days to appear in Court from the day the summons has been issued. Upon failure, the Court shall pass an ex parte decree. Defendants are automatically not given the chance to be heard but they can apply for a “leave to defend” with the reasons attached. The Court shall determine whether the conditions are sufficient for the grant or not.

These types of suits can only be filed in a limited number of cases such as bills of exchange or promissory notes, guarantees, contracts, etc.

Frequently Asked Qustions:

Any debt-related suit can be recovered by filing a case in the Debt Recovery Tribunal under the appropriate jurisdiction. here the summary suit under Order XXXVII comes into play. this is one of the fastest ways to recover your money.

The limitation period is provided under the Schedule of this Code. in cases where the money is borrowed but not returned, then the limitation period for filing such a suit is three years from the date the money has not been returned.

Yes. Court fees are necessary for the trial to proceed. The Court fees need to be filled by the person commencing the trial. A suit shall not be allowed if it is not filed along with the court fees.

Users not registered with Strictlylegal can Email us their content and the same are posted through this account. In case of abuse, kindly let us know at [email protected]