A demand notice is a legal intimation of debt owed and the last request to repay the amount failing which legal consequences follow.

In cases relating to the Debt Recovery Tribunal or under Section 13(2) in The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFESI ACT) it is mandated that the creditor should send a notice in writing asking the borrower to discharge its liability.

(2) Where any borrower, who is under a liability to a secured creditor under a security agreement, makes any default in repayment of secured debt or any instalment thereof, and his account in respect of such debt is classified by the secured creditor as non-performing asset, then, the secured creditor may require the borrower by notice in writing to discharge in full his liabilities to the secured creditor within sixty days from the date of notice failing which the secured creditor shall be entitled to exercise all or any of the rights under sub-section (4).

SARFESI ACT

Do you want us to specially draft you a demand notice or any other legal notice?

>Send a notice online under the seal and signature of an advocate starting at Rs. 599

Table of Contents

Download Demand Notice Sample Format

A sample format of the Demand notice can be found below. you can edit the details as far as applicable and send them right away or as per the instructions of your advocate.

You can copy the demand notice for loan repayment/ 13(2) notice format/ loan recall notice from the below:

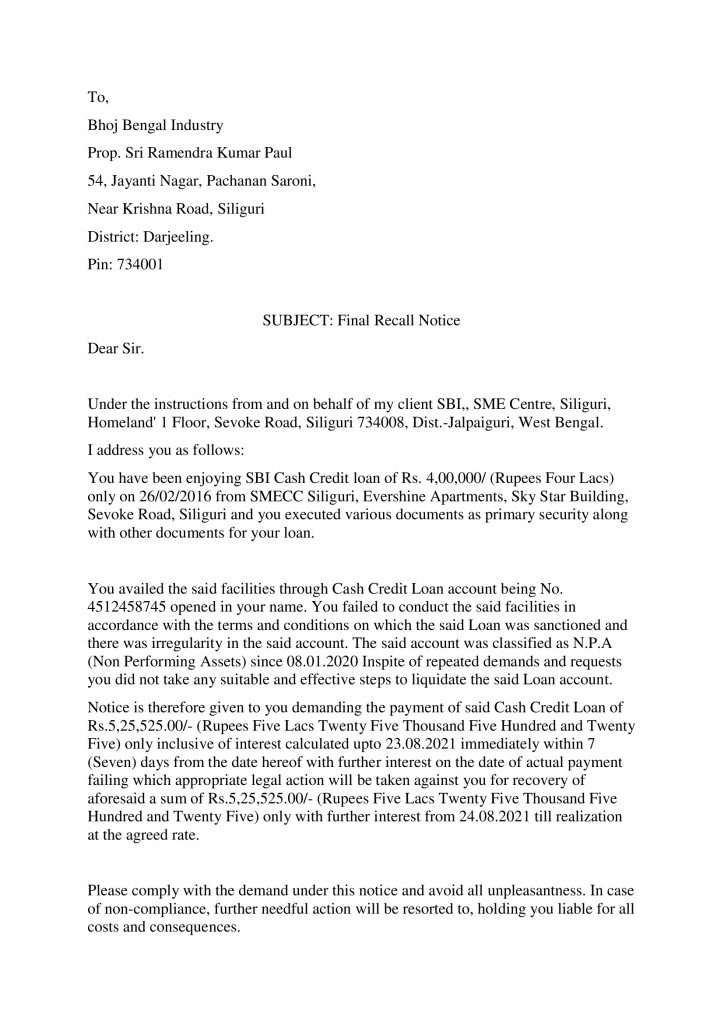

To,

Bhoj Bengal Industry

Prop. Sri Ramendra Kumar Paul

54, Jayanti Nagar, Pachanan Saroni,

Near Krishna Road, Siliguri

District: Darjeeling.

Pin: 734001

SUBJECT: Final Recall Notice

Dear Sir.

Under the instructions from and on behalf of my client SBI,, SME Centre, Siliguri, Homeland’ 1 Floor, Sevoke Road, Siliguri 734008, Dist.-Jalpaiguri, West Bengal.

I address you as follows:

You have been enjoying an SBI Cash Credit loan of Rs. 4,00,000/ (Rupees Four Lacs) only on 26/02/2016 from SMECC Siliguri, Evershine Apartments, Sky Star Building, Sevoke Road, Siliguri and you executed various documents as primary security along with other documents for your loan.

You availed of the said facilities through Cash Credit Loan account being No. 4512458745 opened in your name. You failed to conduct the said facilities in accordance with the terms and conditions on which the said Loan was sanctioned and there was an irregularity in the said account. The said account was classified as N.P.A (Non-Performing Assets) since 08.01.2020 In spite of repeated demands and requests you did not take any suitable and effective steps to liquidate the said Loan account.

Notice is therefore given to you demanding the payment of said Cash Credit Loan of Rs.5,25,525.00/- (Rupees Five Lacs Twenty Five Thousand Five Hundred and Twenty Five) only inclusive of interest calculated up to 23.08.2021 immediately within 7 (seven) days from the date hereof with further interest on the date of actual payment failing which appropriate legal action will be taken against you for recovery of aforesaid a sum of Rs.5,25,525.00/- (Rupees Five Lacs Twenty Five Thousand Five Hundred and Twenty Five) only with further interest from 24.08.2021 till realization at the agreed rate.

Please comply with the demand under this notice and avoid all unpleasantness. In case of non-compliance, further needful action will be resorted to, holding you liable for all costs and consequences.

Please note that in case if a case is filed, you shall also be held responsible and liable to pay all costs, charges, and expenses that will be incurred by my client on that behalf.

Thanking You,

Yours faithfully

Want to Download Similar Drafts?

Get 2050+ Files containing all drafts from Agreements to petitions. From District Courts to Supreme Court. All covered. Civil & Criminal, Company, and everything else. All in one click. You name it, we’ll probably have it. Click the link below to preview and download legal drafts.

Things you should clearly mention in your Notice

- The date when the debt agreement or loan was undertaken

- The Amount due to be recovered

- The failed dates of repayment or default date

- When the cause of action arose

- Full name and address of the defaulter

- Full name and address of the person from whom loan was taken

- Any other details of the liability

- Assets mortgaged details

- Rate and total amount of interest accrued for non payment.

- Consequences for non payment within stipulated time.

Conclusion: To sum it up together

Demand notice is an intimation of demand or claim made by one party to another containing statement of particulars, demand for payment and warning that if such payment is not made within a reasonable time, necessary action would be initiated against him/her. Demand notice may be written or verbal depending on the nature of claim.

A demand notice can also serve as a reminder to pay outstanding dues before initiating further steps. A demand notice should contain the following:

1) Name and address of person entitled to receive it; 2) Particulars of Debt: It should contain detailed information about the money due and payable along with the time period for payment; 3) Intimation of impending legal proceedings if amount is not paid within the stipulated time.

4) A demand notice may be sent by registered post or by hand, with acknowledgement due; 5) If no acknowledgement is received within 15 days of issue of notice, it will be presumed that the person has received it according to law.

A demand notice can be sent either personally or through an advocate/ business agent/ relative etc. Demand notices are normally based on written agreement between parties legally enforceable under law. In case any one disputes its genuineness or does not comply then Section 89(1) CrPc empowers a court to pass a decree against such party after giving three months’ opportunity to that party without taking into consideration such denial or non-compliance.

Passionate about using the law to make a difference in people’s lives. An Advocate by profession.