Cheques are one of the most widely used negotiable instruments in India for business, personal, and commercial transactions. However, the misuse of cheques—particularly issuing them without sufficient funds—has become a common problem. To protect the integrity of financial transactions, the Negotiable Instruments Act, 1881 (NI Act) was amended to include penal provisions for cheque dishonour.

Section 138 of the NI Act, 1881 makes the dishonour of cheques due to insufficient funds or other payer-related reasons a punishable offence. It ensures that payees (the recipients of cheques) are not left helpless if the cheque issued to them is dishonoured.

This article explains in detail what cheque bounce means, the procedure for issuing a cheque bounce notice, the time limits involved, the penalties, and remedies available under law.

A cheque bounce notice is a serious notification sent to the payer of the cheque that his issued cheque was dishonored for reasons mentioned therein and that he must arrange an alternative way of payment within a reasonable time or else the payee has every right to move court under section 138 of the negotiable instruments act.

Table of Contents

How to issue cheque bounce notice?

Section 138 notice or cheque bounce notice can be issued in two ways.

- Under your own name.

- By an advocate on behalf of you [Recommended]

It is always advisable to send the section 138 notice under the name and seal of an advocate. Advocate notice for cheque dishonor carries more authority than a normal notice by the payee himself.

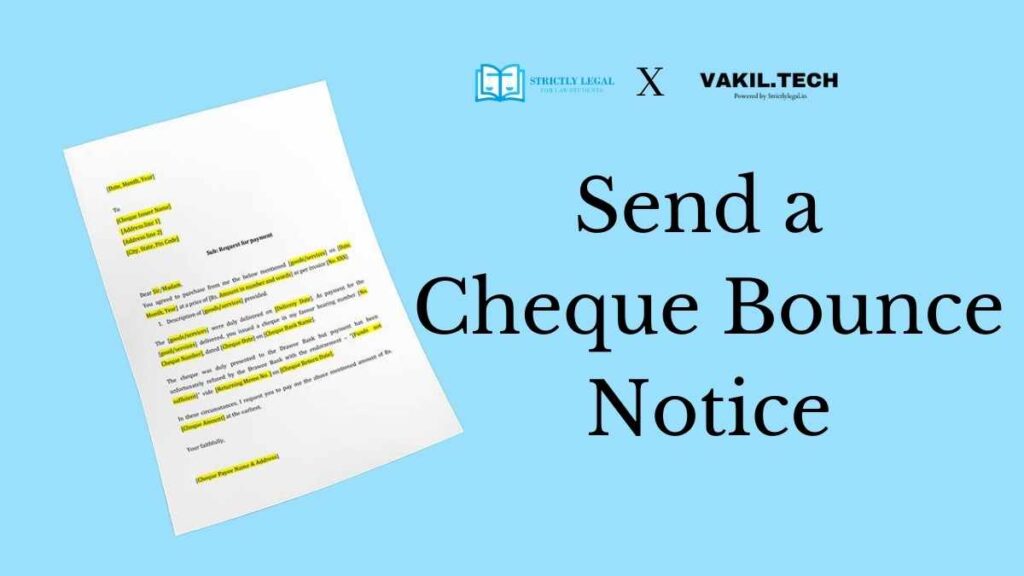

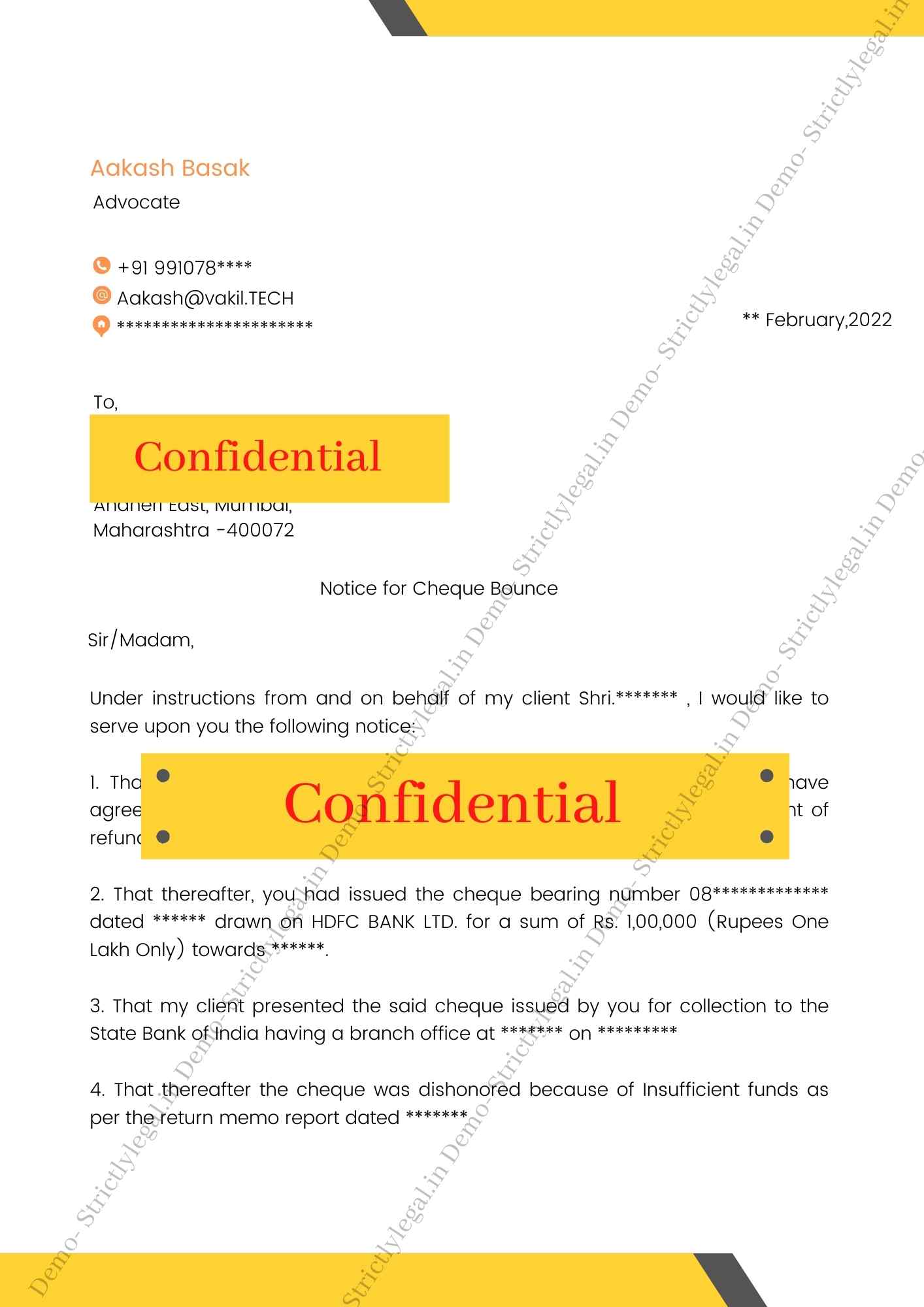

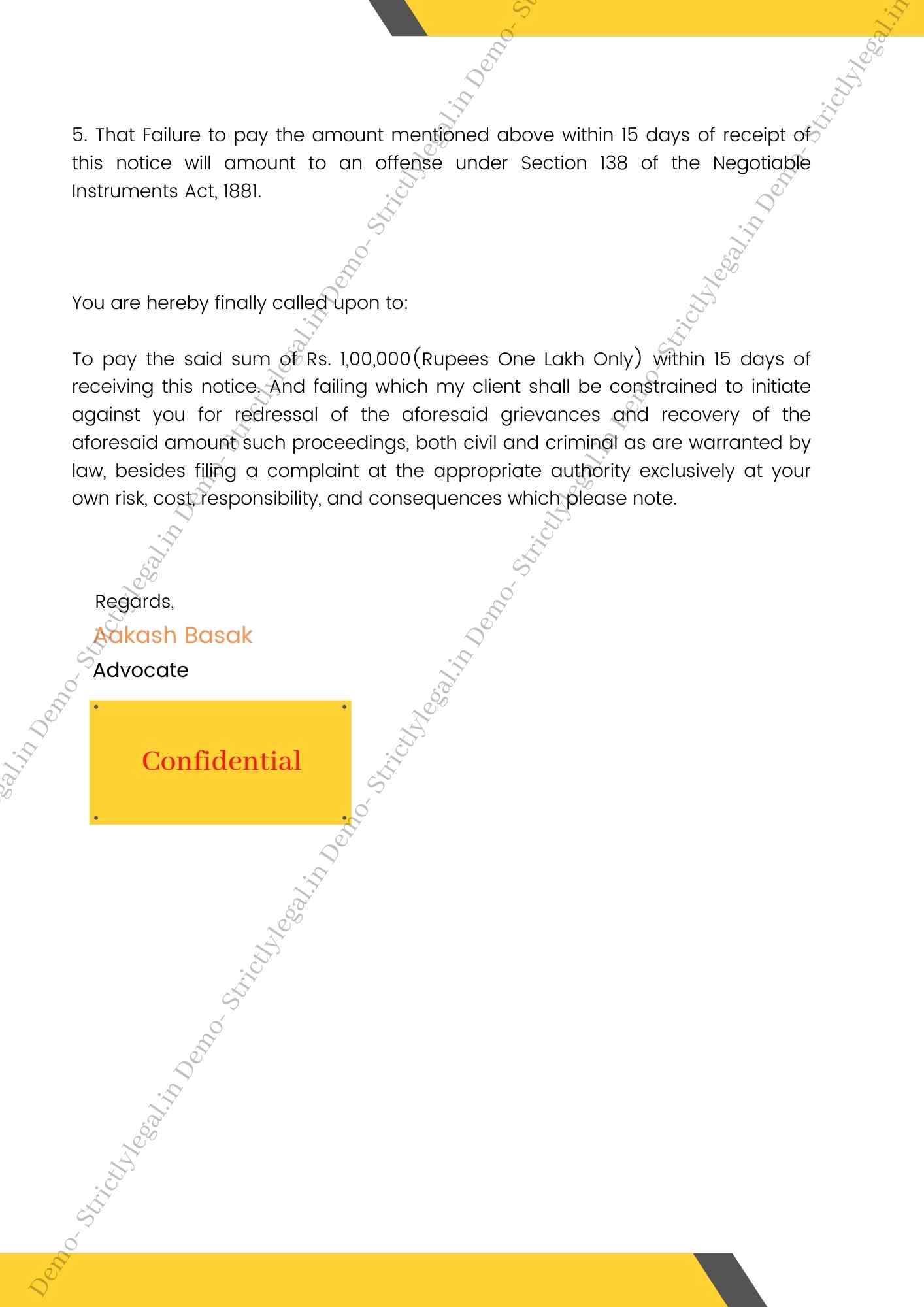

How does a lawyer notice for cheque bounce look like?

The cheque bounce notice format is attached below. This was issued by an advocate under his name and seal.

When 138 notice can be issued?

A section 138 notice or a cheque bounce notice can be issued as a matter of right if certain conditions are fulfilled:

- The cheque must have been presented within 3 months of its issue. (It must be valid)

- It must be paid towards any legally enforceable debt or liability and not charity or gift.

- It must be returned by the paying banker because of Insufficient funds or such other reason solyly attributable to the payer of the cheque.

Legal Action for Cheque Bounce

A 138 notice or a notice for cheque bounce must be served on the payer requesting him to make alternative arrangements to pay the default sum of money within a reasonable period of time. (Say 15 days of receiving the notice) and if he/she fails to pay then legal action under section 138 of the Negotiable instruments act can be taken.

The payer of the cheque can be liable for an imprisonment of up to 2 years or with a fine up to two times that of the returned cheque or with both fine and imprisonment. It must be noted that the notice under section 138 must be served within 30 days from the return of the cheque by the banker.

If the payer of the cheque still does not pay the defaulting amount within 15 days of receiving the notice, the payee has the legal remedy to file a case at the criminal court. Once the case is taken up, the magistrate would issue a summon and the defaulting payer has to answer before the magistrate. If found guilty he can either be imprisoned for up to 2 years or with a fine of up to two times that of the returned cheque or with both.

Cheque Bounce for Companies

If the defaulting party or the payer of the cheque whose cheque was dishonored is a company then it will be dealt with under section 141 of the Negotiable Instruments Act, 1881.

Since the company is a separate entity who shall be charged with the offense?

Section 141 states that any person who was in charge of or was responsible for the conduct of such business shall be held liable. Provided that he/she shall not be liable if it is proved that such a thing happened without their knowledge or that he /she had exercised all due diligence to avoid it from happening.

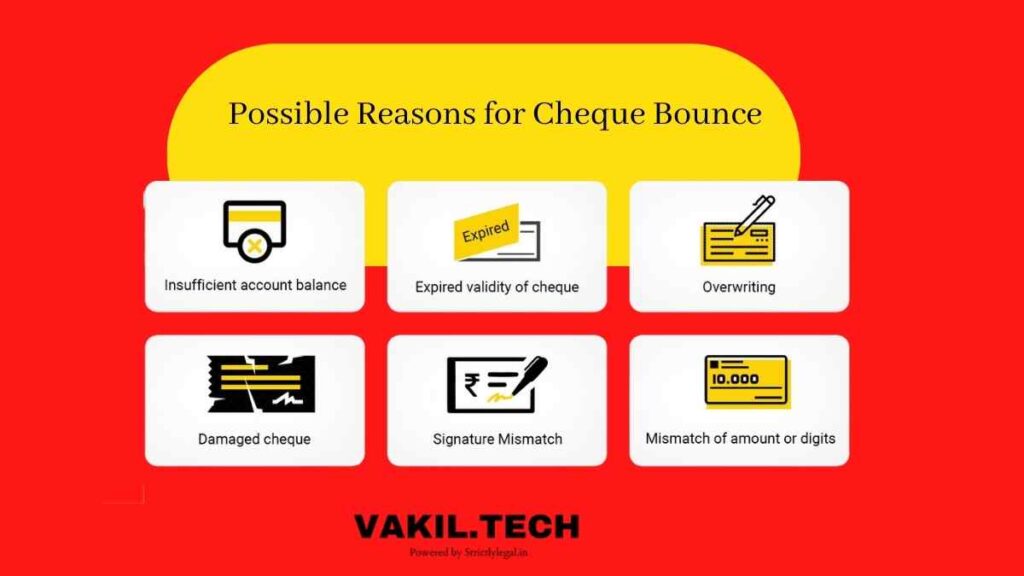

Reasons for Cheque Dishonour

There could be a variety of reasons why a could be dishonored by the banker such as:

- Signature mismatch or Mismatch of other data

- Stop payment instruction

- Alterations and overwriting

- Post-date Cheque

- Stale cheque i.e cheques presented beyond its validity period

- Etc.

The payer of the cheque can be held liable under section 138 only if one of the two conditions for dishonor are satisfied:

- Either because of the amount of money standing to the credit of that account is insufficient to honour the cheque

- Or that it exceeds the amount arranged to be paid from that account by an agreement made with that bank.

- Or such other rason soly attributable to the payer of the cheque,

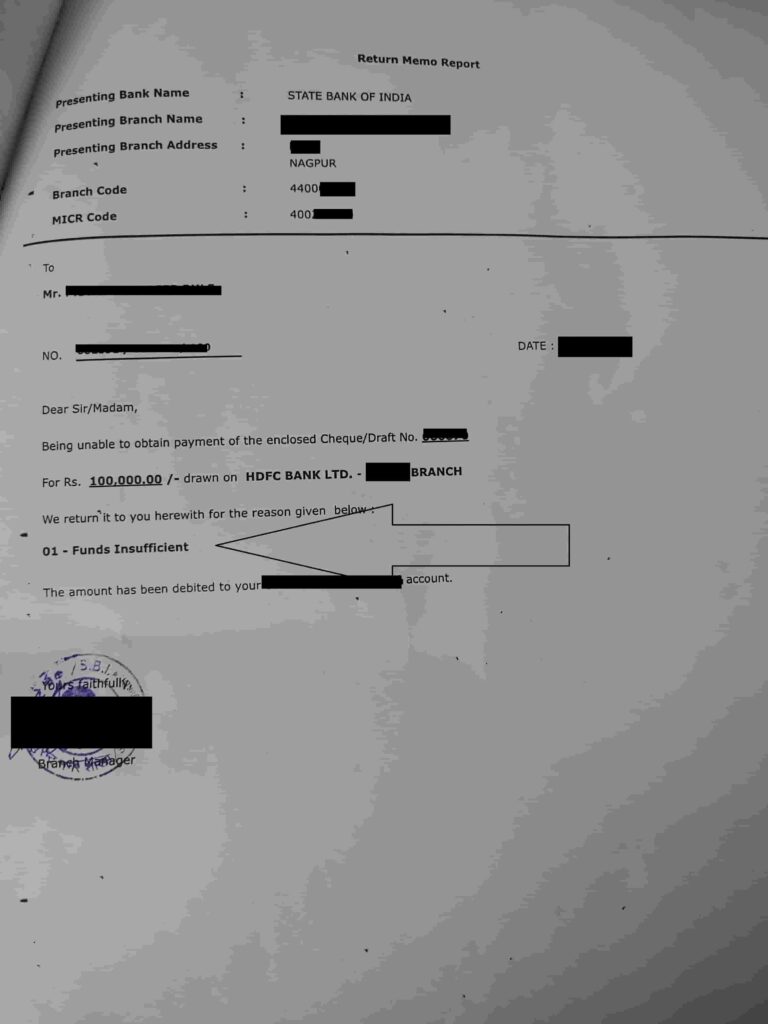

What does a returned cheque from bank look like?

A returned cheque is notified to the payee along with the return memo report where the reasons and other details are mentioned for the dishonor. You can see it from the below image.

How do I write legal notice for cheque bounce?

In case you want to write the notice yourself instead of taking help from a lawyer, you need to mention these details:

- The details of transaction

- The details of cheque bounce i.e date of issue, date of presentation of cheque etc

- The details of the returned cheque along with the reasons of dishonour as mentioned in the cheque return memo.

- A reference to Section 138 Negotiable Instrument Act, 1881 [Mandatory]

- Details of the cheque number, date and amount.

- Mention details of arrangememt for alternative payment.

More details about Parties to a cheque

Here’s a quick glossary of terms that you might be confused with:

- Payer: It is the person who issues the cheque. He is also called the author of the cheque. He also signs the cheque.

- Payee: It is the person in whose favour the cheque was issues. In other words, it is the person that was supposed to recieve the money from the cheque.

- Paying Banker: It is the bank who pays the money on behalf of the payer.

Also Read: Everything About Clearing Cheques & Paying Banker

Procedure for Taking Legal Action

- Cheque Return – Bank issues a return memo stating the reason for dishonour.

- Issuing Notice – Payee must send a written legal notice to the drawer within 30 days of receiving the return memo.

- Waiting Period – Drawer gets 15 days from receipt of notice to make the payment.

- Filing Complaint – If payment is not made, the payee may file a criminal complaint under Section 138 before the Magistrate’s Court within 30 days after the expiry of the 15-day period.

- Court Process –

- Magistrate issues summons.

- Drawer must appear before the court.

- If found guilty, punishment includes fine, imprisonment, or both.

Frequently asked questions

A must under section 138 Negotiable Instruments Act, 1881 must be served within 30 days of getting the cheque returned unpaid from the bank.

The payee must serve a notice on the payer that his cheque was dishonored through an advocate within 30 days of receiving the cheque unpaid from the bank.

Yes, cheque bounce cases are heard at the criminal court. It is civil in nature but penal provisions such as the imprisonment of up to 2 years were later added.

If you’ve ever faced a cheque bounce situation in India, you know how stressful it can be. Whether you are a business owner waiting for payments or an individual relying on a cheque, a dishonoured cheque often feels like a betrayal of trust. That’s why the law under Section 138 of the Negotiable Instruments Act, 1881 was created—to protect people from the misuse of cheques. When a cheque is returned unpaid due to insufficient funds, account closure, or other payer-related reasons, it is considered a serious offence. In such cases, the payee has the right to issue a cheque bounce notice within 30 days of receiving the bank’s return memo, demanding repayment within 15 days. If the payer still fails to clear the dues, legal action can be initiated in a criminal court. The punishment may include imprisonment of up to two years or a fine of up to double the cheque amount. To avoid complications, it’s always advisable to take the help of a lawyer in drafting and sending the notice. Understanding the law on cheque dishonour in India not only helps protect your rights but also ensures smoother financial dealings in both personal and business transactions.

Passionate about using the law to make a difference in people’s lives. An Advocate by profession.